The current state of affairs of offshore wind energy in Ireland

Ireland has set a target of at least 5 GW of offshore wind capacity by 2030, with further expansion to more than 20 GW by 2040. A key focus is on floating wind farms along the west coast, where the deeper waters require this technology. These ambitious plans are a key part of the country's broader strategy to become climate neutral by 2050.

Want to know more about opportunity for your business in Ireland? Get in touch with Michael Murphy.

Port infrastructure and logistics

Key ports are evolving into major offshore wind hubs:

- Rosslare Europort is expanding through land reclamation and positions itself as a national ORE hub;

- Port of Cork increases its assembly and storage capacity thanks to significant investment;

- Shannon Foynes focuses on deepwater facilities for floating wind turbines;

- Greenore Port has received approval for an expansion for operations & maintenance (O&M).

Tendering and market access

Ireland organises auctions through the Offshore Renewable Electricity Support Scheme (ORESS):

- ORESS 1 (2023) awarded contracts to five projects on the east coast.

- ORESS 2.1 (2024) allocates 900 MW of offshore wind capacity.

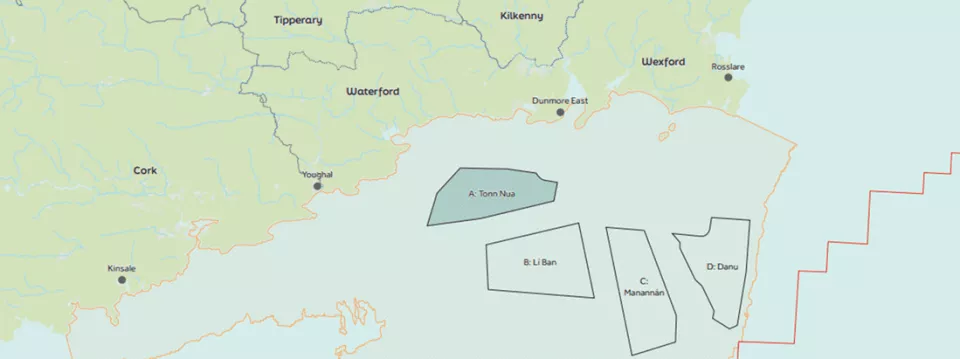

- ORESS Tonn Nua (2025) focuses on the south coast.

A national Designated Maritime Area Plan (DMAP) is under development (2025). This plan will designate further zones for offshore wind.

Development of offshore grid infrastructure

EirGrid, the national grid operator, plays a key role in connecting offshore wind energy to the Irish grid. Under the government-led planned offshore development model, EirGrid is responsible for constructing both offshore and onshore transmission infrastructure so that wind energy can be efficiently fed into the grid.

Under the Powering Up Offshore - South Coast project, EirGrid is developing two offshore substation platforms in the Tonn Nua area. Those platforms will be connected to new landing points and onshore substations in the Cork and Waterford/Wexford regions. This will enable the connection of 900 MW of offshore wind capacity from the south coast.

To realise these ambitious plans, EirGrid has launched a large-scale procurement programme worth more than €1 billion. This procurement covers diverse operational and maintenance services, such as subsea inspection and repair, maritime logistics, asset monitoring, safety services, training and even helicopter support.

The initiative represents a clear call to international and local suppliers to actively contribute to building Ireland's offshore grid capacity and sustainable energy supply.

Main projects under development

| Project | Developer(s) | Capacity | Location |

| Oriel Wind Park | Parkwind / ESB | 375 MW | County Louth |

| North Irish Sea Array | Statkraft / CIP | 500 MW | 13–22 km off the coast |

| Dublin Array | RWE / Saorgus Energy | 824 MW | Kish & Bray Banks |

| Codling Wind Park | Fred. Olsen / EDF Renewables | 1,300 MW | Between Greystones & Wicklow |

| Arklow Bank Phase 2 | SSE Renewables | 800 MW | Arklow coast |

Challenges for roll-out

Although Ireland has great ambitions, the sector is still in a start-up phase and therefore faces several challenges:

- The regulatory framework (MAP Act, DMAPs) is new and complex.

- Licensing processes are still slow and unpredictable.

- Limited installation logistics and grid capacity slow down realisation.

- Cost increases and uncertainty about support regimes (such as CfDs) put pressure on margins.

Opportunities for Belgian companies

Ireland's offshore wind sector is at the beginning of an impressive growth phase. Concrete opportunities lie here for Belgian companies with expertise in maritime infrastructure, engineering, logistics or sustainable technology.

🔹 From foundations to cable installation

🔹 From port logistics to digital monitoring

🔹 From grid development to circular solutions

Want to know where exactly the opportunities lie, which players are active in the market, and how you as a Belgian company can get in? Then contact our colleague Michael Murphy for exploratory talks or a targeted market update.

Conclusion

Ireland is developing into a major offshore wind hub, with government ambitions, project development and port expansion continuing well beyond 2030. Cooperation between international consortia and the Irish government offers clear entry points through tenders and infrastructure projects. For Belgian companies, there are relevant, real opportunities across the entire value chain - from grid development and port logistics to floating wind and digitalisation.